what is a tax lottery

Proponents of lottery play say that this is due to a misunderstanding between purchasing a product and paying a tax. Regardless of their tax status people should not become addicted to lottery playing.

Lottery And Taxes What You Need To Know Before Claiming Your Prize

Say you win a 447 million lottery jackpot and opt to take lump sum payout typically about 66 of the total advertised jackpot Pagliarini notes over the annuity option.

. While some are lucky enough to be citizens in countries with no taxes many others face high tax rates that leave. The lottery tax in Texas is 0 so there are no state taxes on your lottery prize. Most lottery winners want a lump sum payment immediately.

However if your newfound wealth puts you in the top tax bracket this rate increases. Texas Lottery - Play the Games of Texas. The federal government will withhold 24 of your winnings to go toward federal taxes.

Cash donations are limited to 60. If this new income. Then they can choose to.

The tax percentage varies depending on the players country or state. While many people find lotteries a fun form of entertainment some argue that they are a waste of money. This means your income will be pushed into the highest federal tax rate which.

Your lottery winnings are taxed just as if they were an ordinary income bonus. Taxes On Lottery Winnings By State 2021. Federal and state tax for lottery winnings on lump sum and annuity payments in the USA.

Taxes 101 Taxes on US lottery winnings are a bit more complicated than some other nations games because they differ depending on the state where the ticket is purchased. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. State Taxes on Lottery Winnings.

How much tax do I pay if I win the lottery. That means your winnings are taxed the same as your wages or salary. The federal government and all but a few state governments will immediately have their hands out for a bit of your prize.

Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. The federal tax rate for lottery winnings totally depends on the number of lottery winnings and can go up to a maximum of 37. In Kerala state Govt lottery above 10000 Rupees of any prize money 10 of Agent commission 30 of income tax will.

Most prize winners pay a fixed federal income tax rate of 24 on their lottery winnings over 59999. The lottery is a form of gambling that raises money for the government. Like other income in the United States the IRS taxes lottery winnings.

The tax rate on lottery winnings depends on your income tax bracket. Whats the tax rate on lottery winnings. While lotteries are tax-free in.

Lotteries also generate significant revenue for the government. The lottery is not a hidden tax but a form of implicit tax. How much do you pay in taxes if.

The highest federal tax bracket is 37. Taxes on lottery winnings by state local tax. The 37 tax rate applies to.

What is the income tax on lottery winnings in Kerala. 10 Million Next Draw. Next in line is the federal tax bill.

So if you win 100000 in the lottery and give 20000 to Easter Seals then your taxable income from the lottery winnings would be 80000.

Taxes On Lottery Winnings In Kentucky Sapling

Lottery Tax Rates Vary Greatly By State Tax Foundation

Metal Sign Lottery A Tax On People Who Are Bad At Math Ebay

Mega Millions Lottery Winner Of 1 28b Will Get 433 7m Post Taxes

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/54M3QN7SLJF3PAKOUBI2VGPK6A.jpg)

How Much Money Will You Get After Taxes If You Win The Mega Millions Jackpot Kiro 7 News Seattle

How Much Tax Would You Have To Pay If You Win The 1 1 Billion Mega Millions Jackpot As Usa

Here S The Tax Bill If You Hit The 495 Million Powerball Jackpot

Know How Much Taxes You Will Pay After Winning The Lottery

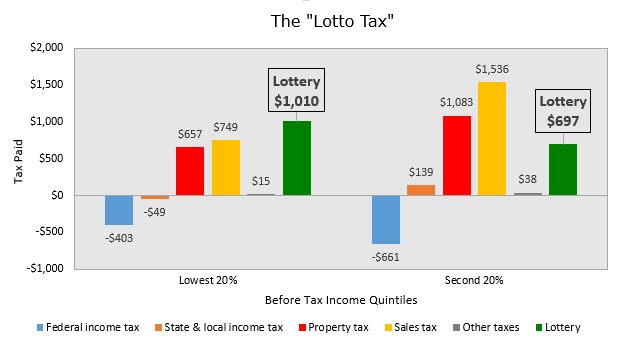

Why The Lottery Is A Regressive Tax On The Nation S Poorest

How Are Lottery Winnings Taxed

Losing Lottery Tickets And What We Learn About Tax Evasion From Them Unc Tax Center

Powerball Jackpot Taxes Changes In The New Tax Law For Winner Money

The Best And Worst States For Winners Of The Billion Dollar Powerball Lottery

Do I Have To Pay Taxes On Lottery Winnings Credit Karma

Lottery Taxes The Triple Tax Effect Ellsworth Associates Cpas Accountants In Cincinnati

The Single Largest Tax On Poor Families The Lottery Metrocosm

New Tax Code Impacts Lottery Prizes

1 6 Billion Lottery Winner Will Face Huge Taxes Possible Lawsuits